Short-Term Noise Can Lead to Long-Term Opportunity

Key Summary:

- Markets have more noise and volatility than ever before.

- The best forward returns happen when we build bigger positions in noisy periods.

- Being a contrarian when fear, uncertainty, and panic has historically paid handsomely.

Very Important thesis: If equities generate roughly ~10-11% a year over time, the best companies with leading brands and dominant global franchises, in theory, should compound at 13-15%+ over time. Looking backward, that is exactly what’s happened. Our best opportunity as an investor: buy more great brands when the market acts irrationally short-term. Your long-term returns will thank you.

Today’s Short-term Noise Won’t Last Forever.

With so much fear, uncertainty, and doubt (FUD) in markets and the economy today, I thought I would try and turn this frown upside down using some contrarian thinking. I’ve been an investor for 30 years now, so I’ve seen a lot of different kinds of markets. Between the Internet boom and bust, to the raging housing boom and crash during the GFC to the Covid crash and money printing experiment that created the interest rate and inflationary “normalization” process, the ride has been a wild one. During times like today, it’s important to remember that the short periods of FUD, like hurricanes, don’t generally last very long and when the uncertainty starts to wane, stocks and animal spirits wake up in a big way. It’s only a matter of time.

If you only take one thing from today’s musing, take this: storms are a sideshow to sunnier days. Markets go up 80-85% of the time so it’s in the down periods that we get an opportunity to buy great merchandise on sale so when the sun comes out again, you’ll own more quality and your speed to recovery gets accelerated.

Pessimism is Everywhere. Contrarian Signal?

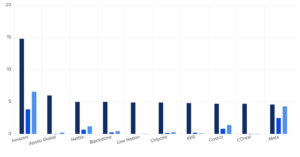

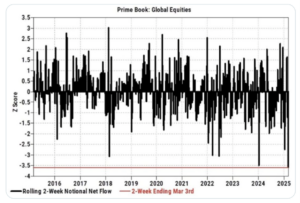

We live in very interesting times. Tariff announcements are happening daily. Self-induced cracks in the economy are developing. Friction is developing between U.S. politicians and our allies. This is a moment in time and cooler heads will prevail in time. Clearly, the market is sniffing out a slowing of economic growth coming from policy uncertainty. While deep selloffs never feel good, this one in particular feels quite extreme because investors of all kinds have simply decided to “step-away” from markets until some certainty re-appears. The selling has been persistent because it’s a 1-sided market for now. Buyers are on strike, sellers and shorts are bold. Need proof? The below chart from Goldman Sachs shows how severe the de-risking has been in a short period of time. Hedge Funds, CTA’s, systematic investors and even regular retail investors, have all been selling due to high bouts of uncertainty.

With few buyers on the other side, the market just drifts lower, and rallies get sold quickly. Imagine what markets will do if/when there is some better policy certainty, consumers and businesses have a better understanding of the rules of the road and earnings variability stabilizes. Sellers will dry up. Shorts will cover. Animal spirits will return with a vengeance. There will be a lot of buyers all rushing back at once. I suggest we all start building bigger positions so when the party heats up, we have a great seat.

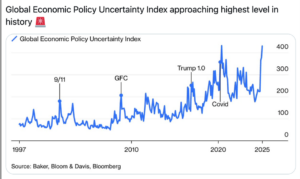

To give you a sense how severe the policy uncertainty is today, the chart below shows an index that measures it. We are higher than any other period over the last 25 years. Kind of incredible really, there were some scary moments in these former spikes. There were some great buying opportunities then too, and they all felt terrible at the time.

To Reiterate:

“De-risked” is not a permanent state. At some point, when either A) markets sell-off to a level where sellers feel like the doom is fully reflected in prices, or B) situations are getting better on a rate of change basis, or C) the major drivers of vol and downside begin to vanish, there’s going to be a complete reversal of the de-risking as re-risking happens all at once. We never know the WHEN, but we do know investors will not stay de-risked forever.

This is not a complex concept but emotionally, it’s often difficult to execute. Trying to pick bottoms is a tricky business, particularly given every day we see a rash of new headlines that algorithms love to trade against. Be systematic about adding exposures to your favorite strategies on deep red days. Do not buy all at once, split your buy orders up and build these positions while the pessimism is incredibly high, and prices are attractive. Remember, volatility and opportunity are neighbors!

Pessimism is Everywhere & It’s at an Extreme.

I cannot tell you when cooler heads will prevail, just that they will one day. I’m sure you have seen all the charts and data showing how cautious and outright pessimistic investors, small businesses and even corporations are becoming. It’s a dangerous game our leaders are playing but the stakes are quite high if they push this too far. Therefore, we should expect they understand the risks too and will manage them accordingly. Here’s a few examples showing the FUD today.

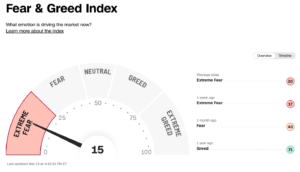

The CNN Fear & Greed Index: Current Reading, Extreme Fear.

This indicator measures 7 important indicators and rolls them into a score. It’s a very low number today, historically a decent spot to start adding to stocks if you have some time. Like most sentiment indicators, only at extremes are they useful as a timing tool.

AAII Sentiment Survey: Current Reading, Extreme Bearishness.

This survey has been around for many decades. It helps to measure how positive or negative investors are, likely biased by current market activity. At the extremes, this bearish view has tended to be a wonderful contrarian buy signal. It’s very rare to see 60% bearishness and <20% bullishness. Historically, these periods offered solid forward returns. Again, having time is important, things can always get more extreme before they get a lot better.

Stock Breadth Washout Signals

One of the ways we measure washouts is knowing what % of the stocks in the S&P 500 and Nasdaq are currently trading above the 20-day moving average. Generally, if under 20% of stocks are trading over the 20day, there’s a decent buying opportunity. Sometimes, volatility and uncertainty are so high, breadth can get fully washed out. I expect that to happen in today’s climate as no end in sight seems visible for these tariff and economic slowdown possibilities The current situation feels a lot like Q4 2018 to me and breadth got to <5% on the Christmas eve low. If we see this kind of extreme reading again in the next month or two, close your eyes and buy some quality stocks, we certainly will with eyes wide open.

Today, March 14, 17% of stocks are trading above this short-term moving average. AKA, we could have more selling until we get fully washed out if politicians keep pushing this odd approach.

Bottom line.

On a day-to-day basis, markets can be volatile. News headlines, earnings, political actions, and plenty of other items can whip-saw our portfolios. The more short-term term we focus, the more angst we can generate. Angst puts pressure on our emotions and emotions make us make irrational decisions. The best advice I can give anyone who invests is this: If you try to wire your brain to be opportunistic when the masses are filled with fear and be cautious when others have euphoria, you will become a very good investor. Over the long-term, your portfolio will look like the green line, in short periods of time, it can look like the yellow line. Today we focus on yellow, but do not lose sight of the green!

Important Disclosure: The above data is for illustrative purposes only. This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.